Looking for a market crash-proof strategy in 2024? Discover the power of utilizing moving averages as an effective approach. This article delves into the benefits, implementation, and FAQs surrounding the “Market Crash Proof: An Effective Strategy Utilizing Moving Averages in 2024.”

Contents

Introduction

In the ever-changing landscape of the financial market, investors are constantly searching for strategies that can withstand the volatility and uncertainty. With the looming possibility of a market crash in 2024, it becomes crucial to identify an effective approach to protect investments. One such strategy gaining popularity is the utilization of moving averages. This article will delve into the power of moving averages as a market crash-proof strategy, exploring its benefits, implementation, and commonly asked questions.

In the world of trading, it is essential to have a solid strategy that can identify high probability trading opportunities. This article will teach you three crucial components of trading that will help you become a more successful trader. By utilizing moving averages and candlestick patterns, you can pinpoint zones in the market with a high likelihood of trading opportunities.

Market Crash Proof: An Effective Strategy Utilizing Moving Averages in 2024

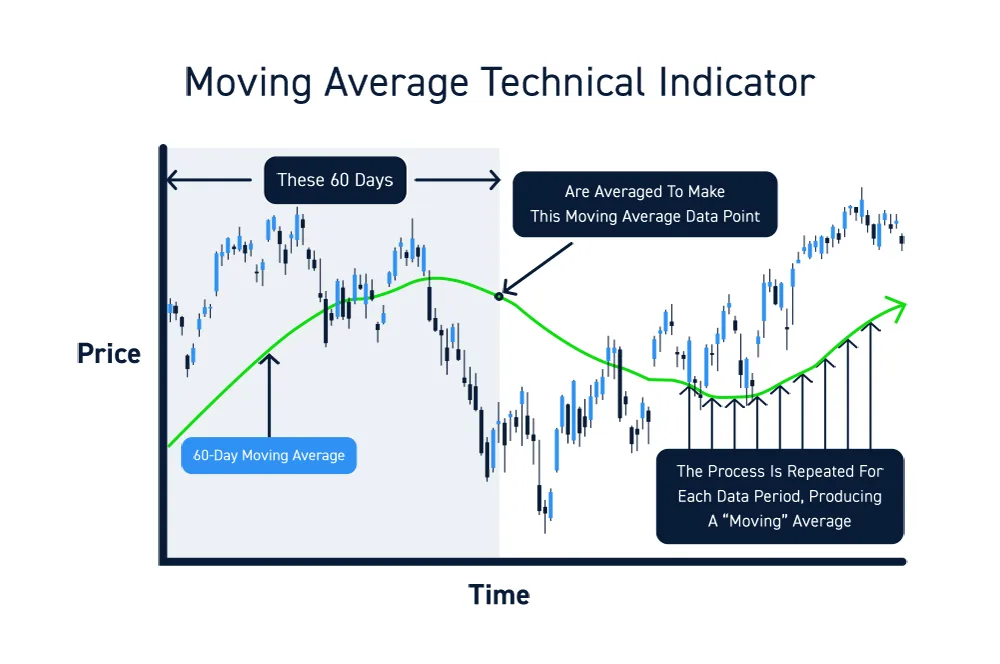

Moving averages have long been recognized as a powerful tool in analyzing market trends and making informed investment decisions. By smoothing out price fluctuations over a specific period, moving averages provide a clearer picture of the overall market direction. When implemented effectively, moving averages can act as a reliable indicator for detecting potential market crashes and helping investors adjust their positions accordingly.

The Basics of Moving Averages

Before delving into the application of moving averages as a market crash-proof strategy, it’s essential to understand the basics. Moving averages are calculated by averaging the prices of a financial instrument over a specified time frame. There are different types of moving averages, such as simple moving averages (SMA) and exponential moving averages (EMA), each with its own strengths and weaknesses.

Benefits of Utilizing Moving Averages in a Market Crash-Proof Strategy

- Smooths Out Market Noise: Moving averages help filter out short-term price fluctuations, allowing investors to focus on the broader market trend.

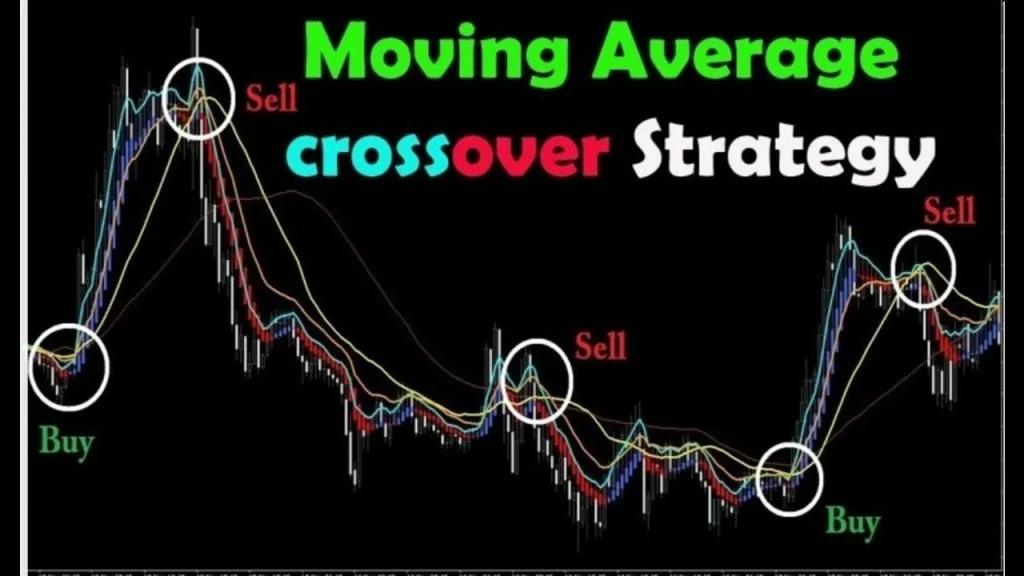

- Identifies Trend Reversals: Moving averages can signal potential trend reversals, providing early warnings for investors to adjust their positions.

- Defines Support and Resistance Levels: Moving averages act as dynamic support and resistance levels, helping investors identify potential buying or selling opportunities.

- Provides Objective Decision-Making: Moving averages provide a clear and objective framework for making investment decisions, reducing emotional biases.

- Adaptable to Different Timeframes: Moving averages can be applied to various timeframes, catering to different investment strategies and preferences.

Implementing Moving Averages as a Market Crash-Proof Strategy

To implement moving averages effectively as a market crash-proof strategy, the following steps are recommended:

- Select the Appropriate Moving Average Type: Choose between simple moving averages (SMA) and exponential moving averages (EMA) based on your preferences and the specific characteristics of the financial instrument you’re analyzing.

- Determine the Timeframe: Decide on the timeframe for the moving average that aligns with your investment goals. Commonly used timeframes include 50-day, 100-day, and 200-day moving averages.

- Plot the Moving Average: Plot the chosen moving average on your price chart to visualize the trend and assess its reliability in detecting market crashes.

- Confirm Market Crash Signals: Utilize additional technical indicators or chart patterns to confirm market crash signals generated by the moving average.

- Implement Risk Management Strategies: Once a market crash is detected, consider implementing risk management strategies such as stop-loss orders or portfolio diversification to protect investments.

Deep Dive in Moving Averages Strategy for 2024

The first part of this strategy involves using moving averages and candlestick patterns to identify areas of value and support and resistance in the market. Specifically, we will focus on three moving averages: the 20 EMA, 50 EMA, and 200 EMA. These moving averages serve as key reference points for identifying trading opportunities. By combining them with candlestick patterns, we can enhance the accuracy of our trades.

Let’s analyze a live trade example using this strategy. Initially, we observe an uptrend with a subsequent reversal, forming what is known as a one-two-three move. This reversal signals a potential bearish trend, which we aim to capture. The next step is to wait for price to pull back to a specific moving average, in this case, the 20 EMA. Additionally, we can look for additional confirmation by identifying levels of structure, such as support or resistance, that have been tested multiple times. In this example, we find a level of support aligning closely with the 20 EMA, further strengthening our trading opportunity.

To refine our entry, we can leverage Candlestick patterns. Zooming in, we identify a shooting star candlestick pattern, indicating buyers’ failed attempt to take control. When this pattern occurs at the confluence of the structure level and the 20 EMA, sellers respond with a long wick, confirming a potential bearish move. Furthermore, a subsequent large red candle provides additional confirmation for our trade entry.

Now that we have established the necessary conditions for our trade, including the one-two-three reversal, pullback to the 20 EMA, and confirmation through Candlestick patterns, we can proceed with placing the trade. It is crucial to set a stop loss, typically a few pips above the high of the shooting star candle, to manage risk effectively. In this case, the ATR (Average True Range) indicates a 45-pip range, which allows us to set a stop loss at approximately 91 pips, ensuring our trade remains safe from major levels. As for the reward-to-risk ratio, we aim for around 1.4 to 1, which represents a favorable risk-reward balance.

With the trade entered, we monitor its progress closely. At a certain point, if price reaches a specific level, we may consider moving the stop loss to break even to protect our profits. It is important to note that trading outcomes are uncertain, and while our analysis and strategy provide a positive expectancy, we must remain adaptable and follow our risk management plan.

Placing trades on the TradingView platform is straightforward. By connecting to a brokerage, you can utilize the platform’s position tool to define your entry, stop loss, and target levels accurately. Once set, you can execute the trade with a single click, ensuring a seamless trading experience. TradingView’s integration with brokers makes it a user-friendly choice for executing trades efficiently.

Now that we have explored the bearish version of this strategy, let’s briefly discuss a bullish variation. In this case, we look for a large impulsive move breaking above a previous level of resistance. A subsequent pullback that touches the 20 EMA and aligns with the tested structure level becomes our entry opportunity.

FAQs (Frequently Asked Questions)

- Q: How do moving averages predict market crashes? A: Moving averages predict market crashes by detecting significant changes in the overall market trend. When the price drops below a moving average, it signals a potential market crash.

- Q: Which moving average type is more effective for crash prediction: SMA or EMA? A: Both SMA and EMA can be effective in crash prediction. SMA is simpler but may have a slight lag, while EMA reacts faster to recent price changes.

- Q: Can moving averages guarantee protection against market crashes? A: Moving averages are not foolproof and should be used in conjunction with other technical analysis tools. They provide valuable insights but cannot guarantee complete protection.

- Q: What other indicators can be used in conjunction with moving averages for crash prediction? A: Oscillators like the Relative Strength Index (RSI) or the Moving Average Convergence Divergence (MACD) can complement moving averages in confirming market crash signals.

- Q: Should I rely solely on moving averages for investment decisions? A: It’s always recommended to consider multiple indicators and factors when making investment decisions. Moving averages should be used as a part of a comprehensive analysis.

- Q: Can moving averages be applied to different financial instruments? A: Yes, moving averages can be applied to various financial instruments such as stocks, currencies, commodities, and indices.

Conclusion

As the year 2024 brings with it the possibility of a market crash, investors must equip themselves with strategies that offer protection and insight. The utilization of moving averages as a market crash-proof strategy has proven to be effective in identifying potential crashes and aiding in decision-making. By smoothing out market noise, defining trend reversals, and providing objective signals, moving averages can serve as a valuable tool in navigating the unpredictable financial market. However, it’s important to remember that no strategy is foolproof, and combining moving averages with other indicators and risk management techniques is crucial for successful investing.

Связь на даче: надежное подключение

мобильный интернет для дома и дачи internetnadachu.su.

Enjoy the Perfect Bali Villa

Villas in Bali – Enjoy Year-Round Comfort and Luxury

Beautiful Bali Villas for Sale – Buy Now

Own a Luxury Villa in Bali

Secure your family’s future with a Bali Villa

Real estate in Bali

Tranquil Bali Villas For Sale

Discover the Secret to a Relaxed Lifestyle

Experience the Best of Bali – Villas for Sale

Live the Luxurious Island Life in Bali

Attractive Bali Villas for Sale}

Beautiful Villas for Sale in Bali – The Perfect Getaway

Live the Luxury Lifestyle in a Bali Villa for Sale

Hello. And Bye.

Hello. And Bye.

Buy a Villa in Bali

Unlock Your Dream Home with a Bali Villa for Sale

Luxury Villas in Bali for Sale

Stylish Bali Villas for Sale

Buy a Bali Villa Property

Beautiful Bali Villas for Sale

Beautiful Bali Villas – Let Your Vacation be Even Better

Buy a Spectacular Bali Property

Find a Luxury Villas in Bali

Looking for a Home in Bali? Get the Best Deals Here

The perfect property for your dream home in Bali!

Какие инструменты нужны для скачивания пари

Выход из кризиса через пари

Быстро и надежно: скачать пари

Скачать бесплатно пари

Простое пари: Собрать Пари

Скачать Пари бесплатно и безопасно

Скачать бесплатно Пари и Получать Бонусы

Просто загрузите Пари и начните зарабатывать деньги

Shaping the Future of Digital Marketing

search engine optomization https://www.cb-top.com/.

Зарабатывайте на Пари сейчас

Ваш будущий финансовый потенциал начинается с Пари!

Топ-Пари для скачивания

Открывай

Get Pari For Free

Скачайте Пари сейчас

Инструкции по скачиванию Пари

За пару минут скачать Пари

Пари – бесплатное скачивание

Полная версия Пари доступна без регистрации

Загрузить Пари бесплатно

Рекомендуемые ссылки для загрузки Пари

Загрузить Пари – бесплатно и безопасно

Быстрый и надежный сервис для скачивания Пари

2.Безопасно и просто скачать Пари

3.Загрузите новейшую версию Пари для вашего устройства

4.Скачайте инновационное Пари

5.Находите правильную версию Пари

6.Удобное скачивание Пари

7.Надежный и беспроблемный способ скачать Пари

8.Быстро и безболезненно скачать и использовать Пари

9.Найдите и скачайте вашу версию Пари

10.Благодаря Пари можно работать быстрее

11.Скачайте Пари и откройте для себя настоящую бесплатность

12.Получение траста с Пари

13.Скачайте и пользуйтесь бесплатными версиями Пари

14.Наслаждайтесь множеством возможностей бесплатного Пари для вашего сервиса

15.Установка Пари за несколько минут

16.Получите доступ к бесплатному Пари, используя простую, интуитивную установку

17.Лучший способ скачать Пари бесплатно

18.Просто и без забот используйте простой способ скачать Пари

19.Шаг за шагом по скачиванию Пари

Bali Land for Sale: A Wise Investment

The Best Bali Real Estate Prices

Purchase a Property in Bali

Incredible Real Estate Opportunities in Bali

Book a Viewing of Bali Real Estate

Получите мгновенную помощь с детективным агентством

официальная проверка автомобиля пробить автомобиль по базе гибдд.

Live the Dream with Bali Real Estate

Luxury Homes |

|

|

Each Unique Property |

Luxury Living at Bali Real Estate |

|

Experience Bali Real Estate |

Unique Listings |

Elite Properties |

Prime Bali Real Estate |

Luxurious Homes |

|

Find your Perfect Home |

Bali Real Estate for Sale |

|

|

Stunning Properties |

Luxurious Listings at Bali Real Estate |

|

Unparalleled Experiences |

Discover Your Dream Home }

Luxury Bali Villas for Sale

Realize your Property Dreams in Bali

Экстрим-приключение в Авиаторе

Авиатор – полет Вашей мечты

Приключения в авиационном царстве

Каждый полёт будет испытанием в Авиаторе

Зарядитесь позитивными эмоциями в Авиаторе

Откройте новые горизонты и высоты в Авиатор

Отряд Авиатор – приключения в небесах

Нескончаемые полеты в Авиаторе

Discover the Casino Experience at Carnival Glory

Пилотируй и приобретай опыт в игре Авиатор

Исследуйте воздушное пространство в игре Авиатор

2. Начните полет в игре Авиатор

3. Превратитесь в Авиатор и получите незабываемые ощущения

4. Проведите приключение в игре Авиатор

5. Открывайте новые миры в игре Авиатор

6. Откройте для себя игру Авиатор

7. Знакомьтесь с удивительным миром игры Авиатор

8. Станьте разведчиком в игре Авиатор

9. Отпра

Try Your Luck at Glory Casino

Welcome to Glory Casino

Соревнуйтесь за выигрыш в Казино Славы

GLORY CASINO – радость и волнение всего в одном месте

Glory Casino – Enjoy Exhilarating Gambling with Us

Путешествуйте в мир Казино Glory

Unlock the Fun At GLORY CASINO

GLORY CASINO: Where Fun Meets Winning

The Best Place to Play

Come Play and Win at Glory Casino

Откройте для себя мир прекрасных игр – присоединяйтесь к Glory Casino

Бонусы и подарки GLORY CASINO

The Magic of GLORY CASINO

Experience the Pleasure of Gambling at GLORY CASINO|Experience the Win at GLORY CASINO|Make Money at GLORY CASINO|Play Anytime at GLORY CASINO|Gambling with GLORY CASINO Anywhere|Enter the World of Gambling at GLORY CASINO|Experience Winning with GLORY CASINO|Safe and Secure Gambling at GLORY CASINO|Win in Style at GLORY CASINO|Always Have Fun at GLORY CASINO|Play and Win with GLORY CASINO|Bet Big , Win Bigger at GLORY CASINO|2020 Best Casino: GLORY CASINO|Risk it All at GLORY CASINO|Plenty of Games at GLORY CASINO|Unlock Rewards with GLORY CASINO|Multitude of Bonuses at GLORY CASINO|Secure Betting at GLORY CASINO|Winning with Security at GLORY CASINO|Winning is Easy with GLORY CASINO|Win Huge at GLORY CASINO|Have Fun with GLORY CASINO

Discover What’s New in AI

Gambling Games Galore at Glory Casino

Подарите себе фишки в GLORY CASINO

Sahabet: Take Online Betting to the Next Level

Play and Lead with Sahabet

Discover Sahabet – Revolutionizing the Online Betting Experience

Sahabet

Fast and Secure Online Betting With Sahabet

Experience a Revolution with Sahabet: Making Online Betting Easier

Специализированные услуги по бурению скважин в Калиниграде

Точное Бурение Скважин для Вас

Бурение скважин с гарантией качества

Профессиональное дебютирование скважин

Качество бурения скважин

Бурение скважин с доставкой на дом

Оценка технологической и экономической эффективности бурения скважин

Бурение скважин: достижение идеального результата

Высокотехнологичное Бурение Скважин для Систем Отопления

Бурение скважин с помощью высоких технологий

Условия для успешного бурения скважин

Надежные результаты бурения скважин

Siteground: Siteground is known for its exceptional speed and advanced security features. They provide excellent customer support, automatic backups, and a user-friendly interface.

Bluehost: It is one of the most popular hosting providers, recommended by WordPress. They offer a user-friendly interface, excellent uptime, and 24/7 customer support. http://webward.pw/.

Disruptive Technology: What It Is and How It Works

How to Get a Crypto Trading License

malta gambling license http://www.cryptofinex.xyz/.

Online Casino Canada – Best Canadian Gambling

Best Canadian Online Casino Games

Buy With Confidence with Our Product Reviews

What is AI and What Does it Mean for Technology?

Tutorials and Tips for Improving Your Knowledge

Eco Travel Adventures – explore the world

Ecotourism routes and expeditions Ecotourism.

Best roulette casino to play in

7s on fire power mix casino game https://bestenroulette.com/.

Live Baccarat

multibet baccarat online slot baccarat casino game.

betty boris and boo blirix workshop casino game.

Professionally Made Stamps

design your own stamps http://www.stamp-maker.us.

crypto license in slovakia crypto license estonia.

Создайте гармонию с домами каркасными

дома каркасные http://www.karkasnye-doma-pod-klyuch78.ru.

Стильный газовый гриль

купить газовый гриль https://bbbqqq11.ru/.

Красочные праздники после похорон

ритуальные услуги круглосуточно https://www.ritual-gratek11.ru.

Доставка цветочных букетов с гарантией качества

купить цветы в москве https://dostavka-cvetov77.ru/.

Автокредит – получите новую машину уже сегодня

кредит авто https://www.tb-avtokredit1.ru/.

Оригинальная версия Winline

Доступная цена на двигатель Cummins

двигатель cummins 2 и 8 http://www.двигатели-для-спецтехники.рф.

Ошибки при заполнении налоговой декларации по НДФЛ

размер подоходного налога для физических лиц в россии 2023 http://www.tb-ndfl1.ru.

Практическое руководство по УСН

усно https://tb-usn1.ru.

Качай Winline бесплатно

Winline для телефона: Скачать бесплатно сейчас

Скачать последнюю версию Winline

Необычные места по странам

авторский тур по байкалу https://www.tours-eks.ru/tours/region/байкал/.

НДС: как учитывать

расчет ндс формула tb-nds1.ru.

Методы бурения и ремонта скважин, чтобы предоставить лучший результат

срочный ремонт скважин http://voda-narodu11.ru/.

Профессиональный производственный календарь на 2023 год

сколько рабочих часов в месяце https://www.tb-proizvodstvennyj-kalendar-2023-1.ru/.

Что такое дебетовая карта?

банки оформить дебетовую карту tb-debetovaya-karta1.ru.

За что платить кредитной картой?

кредитные карты банков http://www.tb-kreditnaya-karta1.ru.

Льготный ипотечный кредит: все преимущества и порядок рассмотрения

льготная ипотека на вторичку http://www.tb-lgotnaya-ipoteka1.ru/.

Квартира в Лимассоле для идеального отдыха

сколько стоит квартира в лимассоле http://kvartira-v-limassole.ru/.

Доступная цена на клинкерную плитку

клинкерная плитка для ступеней на улице https://klinkerprom11.ru/.

Как и где купить доллары дешевле

доллар покупка tb-kupitb-dollar1.ru.

Регистрация ИП: как правильно сделать

открыть ип самостоятельно https://www.tb-otkrytb-ip1.ru/.

Открытие нового ООО: преимущества и шаги

как открыть фирму http://www.tb-otkrytb-ooo1.ru/.

Официальное приложение Winline – скачивайте бесплатно

Как найти билет на самолет по доступной цене

авиа билеты стоимость расписание наличие мест https://www.tb-kupitb-biletb-na-samolet1.ru.

????? ??????: ??????? ?????????? ??????

îôîðìèòü ïîëèñ îñàãî https://www.tb-osago1.ru/.

В чём отличие полиса ОСАГО от каско?

каско рассчитать онлайн https://www.tb-kasko1.ru.

Ипотека на строительство дома: возможности и условия

взять ипотеку в москве https://www.tb-ipoteka1.ru/.

Бесплатная загрузка Winline: топ 5 программ

Найдите лучшее страхование ипотеки за разумные деньги

онлайн калькулятор страхования ипотеки http://www.tb-strahovanie-ipoteki1.ru.

В каких случаях страховка ВЗР может не покрыть расходы на лечение?

купить страховку онлайн для выезда за границу https://www.tb-vzr1.ru.

eSIM и безопасность данных: стоит ли беспокоиться?

sim карта esim http://www.tb-esim1.ru.

Инвестиции: доходный бизнес

что нужно знать начинающему инвестору об инвестициях http://www.tb-investlab1.ru.

Профессиональные услуги клининга для вашего дома или офиса

клининговая компания москва http://klining-moskva-77.ru/.

Перевод технических данных с английского быстро и качественно

технический перевод стоимость 1 страницы https://b2bperevod11.ru/.

Стоимость клининга для дома и офиса: анализ цен и выбор оптимального предложения

уборка квартир после ремонта http://klining-spb-78.ru/uborka-kvartir/uborka-posle-remonta/.

Отличные паракорды на любой вкус

купить паракорд http://www.parakord77.ru/.

Быстро скачайте Winline и станьте частью продвинутой букмекерской системы

Скачайте бесплатно приложение Winline

Какие проблемы решает облачная касса для вашего бизнеса

аренда облачной онлайн кассы oblachnaya-kassa-arenda.ru.

Займы без отказа: получите деньги даже с плохой кредитной историей

моментальные займы на карту http://www.topruscredit11.ru/.

Оптовая и розничная продажа металлопроката от производителя

прокат металла http://www.armatura-krd.ru.

Winline: Присоединяйтесь сейчас и скачивайте приложение!

Станьте профессионалом в изысканиях с помощью допуска СРО изыскателей

сайт сро http://sroforum.ru/.

Оборудование для работы с аргоном в баллонах в процессе сварки: обзор и рекомендации

заправить баллон аргоном в краснодаре http://www.tekhnicheskie-gazy.ru/.

Установка и настройка домофонов и систем видеонаблюдения: советы специалистов

система видеонаблюдения для частного дома https://www.evroks.ru.

Большой выбор качественной спецодежды для всех видов профессий

спецодежда купить https://spetsodezhda-tambov.ru/.

Успешное продвижение сайта – это легко

заказать разработку сайта http://www.s-e-o-paul.ru.

Надежные знаки безопасности и товары для охраны труда по доступным ценам

пожарные знаки безопасности http://www.ets-diesel.ru/.

Кузовной ремонт и покраска авто в Краснодаре: качественно и надежно

покраска машины http://avtoremont18.ru/.

Красивое строительство ангаров и магазинов под ключ

фасад из керамогранита цена за м2 https://www.bystrovozvodimye-zdaniya-krasnoyarsk1.ru/.

Профессиональная реабилитация – путь к здоровью

реабилитация цена медицинская-реабилитация.москва.

Отсутствие ОСАГО и штрафы: что нужно знать каждому водителю

купить страховку на автомобиль осаго https://tb-osago1.ru/.

Удобство использования облачных касс: отзывы и рекомендации клиентов

облачная касса тарифы https://oblachnaya-kassa-arenda.ru/.

Быстрая доставка мешков для мусора по всему городу

мусорные мешки http://www.meshki-dlya-musora-mmm.ru/.

gold cash free spins uk terrific tiger.

Услуги ветеринарной клиники: от диагностики до лечения на дому

узи собаки цена http://www.veterinary-clinic-moscow2.ru.

Только в Риобет казино Вы сможете выиграть больше

riobet casino промокод https://riobetcasino.ru/.

Современное оборудование для быстрого возведения зданий

строительство ангаров цена http://www.bystrovozvodimye-zdaniya-krasnoyarsk1.ru.

Мешки для мусора недорого с доставкой

купить мешки http://meshki-dlya-musoramsk.ru/.

Мусорные мешки: удобство, практичность и доступные цены

мешки http://www.meshki-dlya-musoraru.ru/.

Упростите учет товаров и услуг с 1С УНФ

1с унф фреш https://426clouds.ru.

SEO курсы: Практические советы и рекомендации по продвижению сайтов

курс по seo seo111.ru.

Ingco – Ваш надежный поставщик строительных инструментов

ingco в москве https://ingco-instrument213.ru.

Индивидуальный подход к каждому клиенту при подборе сиделки

сиделка на дому с проживанием http://sidelki39.ru/.

Защитите свой дом от солнца и создайте уютную атмосферу с нашими рулонными шторами

рулонные электрошторы https://www.prokarniz13.ru/.

Пневмоцилиндры под любые задачи и бюджет

пневматический цилиндр https://www.pnevmolab.ru.

Удобный поиск автомобильных весов по параметрам и техническим характеристикам

весы для грузовиков https://baltvesy.ru.

Стильная одежда для малышей с доставкой

одежда для малышей mama-kenguru.ru.

SEO курс для начинающих

семинары seo https://www.seo-fl.ru/.

Какие строительные леса подходят для ремонта квартир и домов

аренда шатров для мероприятий https://www.arenda-stroitelnyih-lesov1.ru.

Клиника остеопатии: профессиональное лечение и забота о вашем здоровье

клиника докторов остеопатии osteopatclinic.ru.

Откройте для себя мир великолепных услуг салонов красоты Новосибирска

маникюр новосибирск http://www.salon-krasotyi-novosibirsk1.ru.

Бесплатные юридические консультации в любое время

вопрос юристу бесплатно http://xn—-12-53dl8bl9bomm8b5a5g.xn--p1ai/.

Пластиковые окна для Вашего дома по выгодной цене

заказать пластиковые окна rehau https://www.plastokoshko.ru/.

Доставка и оплата товаров в интернет магазинах электроники ДНР

интернет магазин техники и электроники https://www.internet-magazin-elektroniki-dnr.ru/.

Строительные леса в аренду – идеальное решение для быстрого и качественного строительства

аренда сцены для мероприятий https://www.arenda-stroitelnyih-lesov1.ru.

Спортивные сувениры: подарки для болельщиков и спортсменов

челябинск сувениры из камня http://www.suveniry-i-podarki11.ru/.

Uncover Mystake Casino Mysterious Slots Paradise

mystake code promo http://www.vpesports11.com.

Максимальная безопасность вашего дома и бизнеса с видеонаблюдением в Краснодаре

диск hdd sata https://evroks.ru/.

Все виды услуг по уходу за вашим телом в салоне красоты Новосибирска

карбамидный педикюр http://www.salon-krasotyi-novosibirsk1.ru.

Раскрутка сайта: стратегии и инструменты для повышения поисковых позиций

оптимизация seo https://www.s-e-o-paul.ru.

top 10 best casinos the best online casinos.

Наша компания окажет помощь в покупке недвижимости в Фамагусте

купить дом на северном кипре https://www.dom-v-famaguste.ru/.

Арматура на базе металлопроката Краснодара

прайс лист металлопрокат http://www.armatura-krd.ru.

e money license estonia cost crypto exchange license panama.

Оказание помощи в получении визы во Францию из Москвы

оформить визу во францию в москве https://visa-vo-franciyu-moskva.ru.

Сроки действия визы в США в Москве

виза в сша сделать в москве http://www.visa-usa-moskva.ru/.

Получение визы для Италии в Москве: Инструкция для туристов

виза италия визовый центр москва http://www.visa-v-italiyu-moskva.ru/.

Срок действия визы Испании из Москвы и сколько стоит виза

получить визу в испанию в москве visa-v-ispaniyu-moskva.ru.

Рекламная полиграфия от надежной типографии

услуги полиграфии – печать упаковки для пищевых продуктов http://envelope-print.ru/.

Виза в Китай в Москве: как получить?

бизнес виза в китай москва visa-v-kitaj-moskva.ru.

Лучшие практики продвижения сайта

полный аудит сайта заказать http://prodvizhenie-sajta.by/.

Продвижение сайта с помощью целевого контента

продвижение сайтов цена http://www.prodvizhenie-sajtov11.ru/.

Покупка квартиры на Кипре в Фамагусте – идеальный выбор для комфортной жизни

купить квартиру в фамагусте северный кипр http://www.kupit-kvartiru-v-famaguste.ru.

Доступный сантехник на дом по лучшим ценам

вызов сантехника на дом https://www.santekhnik-na-dom01.ru.

Уход за деликатными поверхностями мягким бластингом

бластинг москва http://www.myagkii-blasting.ru/.

Комплексная уборка после смерти человека: практичное решение

уборка квартиры после умерших цена https://uborka-posle-smerty.ru/.

Как осуществляется дезинфекция помещений?

дезинфекция после смерти http://www.dezinfekciya-pomeschenii.ru.

Вызвать сантехника – бесплатный выезд по городу

вызвать сантехника http://vyzov-santekhnika-spb.ru/.

Как убрать дом после потопа: полезные советы и рекомендации

уборка домов после залива uborka-posle-potopa.ru.

customer testimonial videos marketing strategy.

Эффективное устранение неприятных запахов в салоне автомобиля с помощью озонирования

озонирование цена http://ozonirovanie-pomeschenii.ru/.

Уборка после затопления канализацией: как правильно выполнить работы

уборка после затопления канализацией https://www.uborka-posle-zatopleniya-kanalizaciei.ru/.

Услуги опытных и проверенных сантехников для вашего дома или офиса

сантехник на дом недорого http://www.uslugi-santekhnika01.ru/.

Комплексный подход к уборке захламленных квартир: быстро и результативно

уборка захламленных и запущенных квартир https://www.uborka-zapuschennih-kvartir.ru.

Быстрое удаление плесени в вашей квартиры с нашей помощью

обработка бетона от грибка и плесени http://www.obrabotka-ot-pleseni.ru.

circuit breakers types of electrical.

Прощание с усопшим после кремации в Москве

кремация сколько стоит в москве http://www.ritual-gratek13.ru/.

Устраним неприятные запахи в помещении: дезодорация квартиры

удаление запаха в антисанитарной квартире dezodoraciya-kvartiri.ru.

Применение двигателей для спецтехники в строительстве

двигатель cummins 5.9 http://www.xn—–6kchfeegdazdfa3aid3b9a2bnk4eva4t.xn--p1ai/.

Курсы перманентного макияжа для начинающих: научитесь создавать идеальные брови

курсы перманентного макияжа https://unopmu11.ru.

Услуги кадрового агентства по подбору и оценке персонала: доверьтесь профессионалам

it кадровое агентство heaad11.ru.

Boost Your Health Through Quality Sleep

binaural beats deep relaxation hypnosis.

Улучшите потенцию с помощью правильных препаратов

Сиалис купить Минск Беларусь 007-apteka.online.

Самые откровенные проститутки в центре Москвы

путаны москвы http://prostitutki-moskvy-city.top/.

SEO, контекстная реклама и другие способы продвижения сайта

заказать продвижение сайта https://www.seodesignbyanton.ru/.

Устранение последствий пожара: клининговая компания

уборка офисов после пожара https://uborka-posle-pojara.ru/.

Unlock Your Mind and Body Power With Self Hypnosis

healnaturally deeprelaxationhypnosis.

Современное решение для вашего дома: электрокарнизы

потолочный электрокарниз https://prokarniz19.ru/.

Откройте новые грани привлекательности с туалетной водой

женские духи http://www.parfumtel.ru/.

Новинка сезона: туалетная вода для современных личностей

женские духи цена http://parfumpin.ru/.

Step Into Splendor: Win Big at Glory Casino

casino glory https://glorycasinopoker.com.

Enjoy Luxury Living in Bali

Real Cash Wins at Glory Cash Casino

glorycash casino online http://www.glorycashcasinos.com.

Discover How to Restore Your Nervous System with Self-Hypnosis

self-reflection mental clarity.

Излечите свою зависимость: Центры лечения наркомании в Алматы

лечение от наркомании цена https://www.lechenienarkomanii.kz.

Banger Casino: Play for Fun and Win Cash

banger casino http://www.casinosbanger.com/.

Glory Casino: Play with Confidence and Win

glory casino online http://www.glorycasinos.org.

Полный спектр бухгалтерских услуг для вашего бизнеса

Бухгалтерские услуги https://www.buhcompany.site/.

Get Your Epic Casino Experience with Glory Casino

casino glory https://glorycasinogambling.com.

Try Your Hand at Glory Casino

glory casino app https://www.theglorycasino.com.

Unsecured Business Loans: The Smart Way to Scale Up

unsecured business loan lenders http://fundkite12.com/.

Live in Paradise: Incredible Bali Villas for Sale Now

Безопасность и контроль: преимущества электронного документооборота

электронный документооборот личный кабинет http://www.ehlektronnyj-dokumentooborot.ru.

Печать на футболках для спортивных команд – побеждайте в стиле

купить футболку с принтом в москве https://www.pechat-na-futbolkah-77.ru/.

amazing link apollo amazing link riches.

Мягкие стеновые панели – красота и удобство домашнего интерьера

мягкие панели на стену на заказ https://soft-wall-panels2.ru.

beachball blast casino game aztec gems deluxe casino game.

Туалетная вода для женщин: почувствуйте себя королевой с ароматом страсти

каталог парфюмерии https://duhifragonard.ru.

Откройте для себя морские просторы: арендуйте яхту сегодня

аренда яхты цена http://arenda-yaht-v-sochi01.ru/.

Get the Best Amirdrassil Boost Now and Unlock the Full Power!

amirdrassil raid boost buy http://amirdrassil-boost.com/.

Флагманский смартфон в ДНР: стиль, мощность и инновации

смартфоны днр https://kupit-smartfon-v-dnr.ru.

Опытные проститутки Москвы – настоящие профи

снять шлюху в москве https://www.prostitutki-i-individualki-moskvy.top/.

Онлайн займы без залога: быстрый перевод денег на вашу карту

сервис онлайн займов на банковскую карту http://www.servis-onlain-zaymov-na-bankovskuyu-kartu.ru/.

Кремация животных в Москве: получите бесплатную помощь сегодня

кремация животных в москве цена 2023 http://usyplenie-zhivotnyh-v-moskve.top/.

Получите займ на карту сегодня без процентов

онлайн займы на банковскую карту круглосуточно zaym-bez-procentov-mgnovenno-kruglosutochno-bez-otkaza.ru.

Оформите займ без процентов: мгновенное одобрение и выдача

мфо первый займ без процентов на карту http://www.bez-procentow-zaim.ru.

Современный комфорт: Управляйте светом с римскими шторами на электроприводе

римские шторы с приводом электрическим http://www.prokarniz24.ru/.

Эвакуаторы для экстренных ситуаций: быстро и надежно

эвакуатор машин https://xn—–6kcagcd2cbog5agfcbgyiqedgw0w.xn--p1ai.

Услуги сантехника 24/7: срочный вызов сантехника в любое время дня и ночи

услуги сантехника https://www.vyzovsantekhnikaspb.ru/.

Выбираем шторы на пульте управления: советы экспертов

жалюзи на пульте управления http://www.prokarniz28.ru/.

Мастер на все руки: услуги сантехника для вашего дома или офиса

вызвать сантехника на дом https://vyzovsantekhnikaspb01.ru.

Ремонт сантехники любой сложности: квалифицированный специалист с 30-летним опытом

сантехник на дом спб https://vyzovsantekhnikaspb1.ru/.

Интеграция программируемых контроллеров в системы автоматизации

программируемый логический контроллер плк http://www.programmiruemie-kontrolleri.ru.

Visa de Tourisme Chine: Planifiez Votre Voyage

visa travail chine https://alsvisa11.com.

ТОП-10 препаратов для потенции: рейтинг и обзоры

Сиалис купить в Минске Гродно Гомеле Могилеве Бресте Витебске https://www.viashop-prokladka1.ru.

real money online casino https://www.allbetzcasino.com/.

Жалюзи с электроприводом: выбор профессионалов

электрические жалюзи на окна https://www.prokarniz23.ru/.

Натуральные средства для мужской силы и потенции

Купить лекарство от аденомы простаты https://007-apteka.online.

Top-Tier WoW Boosts: Enhance Your Gaming Journey Today

wow boost buy https://www.wow–boost.com.

dollar store nail polish.

Профессиональный клининг – заботимся о вашем комфорте

клининг москва http://www.klining–moskva.ru.

Ноутбуки всех форм-факторов и экранов различного размера в наличии в Донецке

поиск ноутбуков донецк днр всех интернет магазин http://kupit-noutbuk-v-dnr.ru/.

industry experts facebook twitter.

Банкротство без проблем в Москве: экспертные услуги

банкротство физических лиц под ключ москва http://1antikollektor.ru/.

Духи Mancera: созданы для тех, кто ценит изысканность

мужские духи mancera mancera http://www.mancera1.ru/.

world wide web johannes gutenberg.

top rated online gambling casino best online casinos list.

Услуги опытного мастера по вскрытию замков в Москве

вскрытие дверных замков в москве https://azs-zamok11.ru.

Профессиональные ритуальные услуги по организации погребения

ритуальные услуги цена ritual-gratek17.ru.

skin pigmentation removal uk https://best-lip-filler.com/.

Experience the Thrill of Playing Casino Games Online for Real Money

casino best online best new casino.

Action and Big Wins

2022 casino best casinos online.

most popular online casino top online real money casinos.

Excellent write-up

Excellent write-up

Outstanding feature

Hiya very nice site!! Man .. Excellent .. Superb ..

I’ll bookmark your blog and take the feeds also?

I’m satisfied to seek out numerous helpful info here within the publish,

we want work out more techniques on this regard, thank you for sharing.

. . . . .

Excellent write-up

Insightful piece

Outstanding feature

Hello it’s me, I am also visiting this web site on a regular basis, this website is in fact nice and the users are in fact

sharing good thoughts.

I was curious if you ever considered changing the structure of your website?

Its very well written; I love what youve got to say.

But maybe you could a little more in the way of content so

people could connect with it better. Youve got an awful lot of

text for only having 1 or two images. Maybe you could space it out better?

Very rapidly this site will be famous amid all blog viewers, due to it’s good posts

Outstanding feature

Excellent write-up

great article

great article

Insightful piece

Outstanding feature

great article

This content is excellent! Clear language, thorough coverage of the topic, and highly engaging. I learned a lot and enjoyed it. Definitely recommended!

I wanted to express how wonderful your post is. I could tell you are an authority on this subject because of how obvious it is. If everything is up to you, I would want to follow your feed so I can be informed when you publish new content. Many thanks, and keep up the fantastic work.