Are you tired of living paycheck to paycheck? Want to get rich in Canada? Do you dream of living a life of luxury and financial independence? If so, you’re not alone. Many Canadians are looking for ways to become millionaires, but they don’t know where to start. In this article, we will explore ten proven ways to get rich in Canada and achieve your financial goals.

Contents

- 1 Introduction

- 2 The 10 Ways to Get Rich in Canada

- 2.1 1. Invest in Real Estate

- 2.2 2. Start a Business

- 2.3 3. Invest in the Stock Market

- 2.4 4. Invest in Cryptocurrency

- 2.5 5. Save and Invest in RRSPs and TFSAs

- 2.6 6. Invest in Gold and Silver

- 2.7 7. Start a Side Hustle

- 2.8 8. Invest in Yourself

- 2.9 9. Take Advantage of Tax Credits and Deductions

- 2.10 10. Live Below Your Means

- 3 How To Get Rich in Canada: 10 Ways To Become a Millionaire (2023)

- 4 FAQs

- 5 Conclusion

Introduction

Becoming a millionaire may seem like an impossible dream, but with the right mindset, tools, and strategies, it’s achievable. In this article, we will share with you ten ways to get rich in Canada in 2023. These methods are tried and tested, and they have helped many Canadians achieve financial independence and live the life of their dreams. Whether you’re starting from scratch or already have some savings, these tips can help you grow your wealth and reach your financial goals.

The 10 Ways to Get Rich in Canada

- Invest in Real Estate

- Start a Business

- Invest in the Stock Market

- Invest in Cryptocurrency

- Save and Invest in RRSPs and TFSAs

- Invest in Gold and Silver

- Start a Side Hustle

- Invest in Yourself

- Take Advantage of Tax Credits and Deductions

- Live Below Your Means

1. Invest in Real Estate

Real estate has always been a popular way to build wealth, and it’s no different in Canada. With a growing population and limited housing supply, real estate prices have been rising steadily over the years. Investing in real estate can provide you with passive income through rental properties and appreciation in value over time.

Just because it is a sure way to build your wealth, it still comes with some risks. Rising property costs in Canada have made a fairly high barrier to entry. You need an initial downpayment which can be a significant amount of money.

When interest rates rise, it can soften the value of your property and even raise your mortgage payments. Ensure you know all the pros and cons before getting involved in the real estate market.

2. Start a Business

Starting a business can be a great way to create wealth and financial freedom. With the rise of e-commerce and online marketplaces, it’s easier than ever to start a business from scratch. You can leverage your skills and passions to create a product or service that meets a demand in the market.

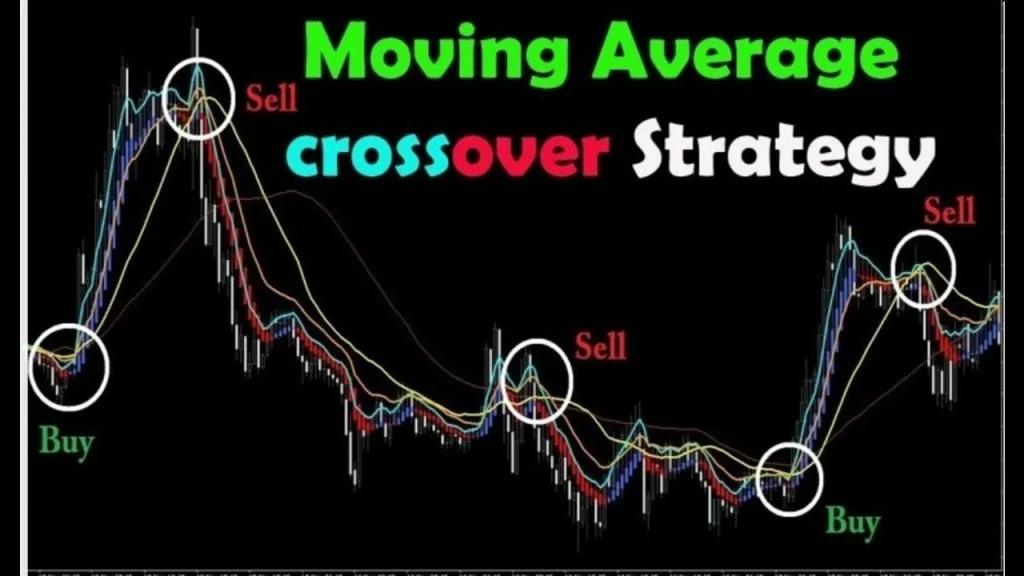

3. Invest in the Stock Market

Investing in the stock market can provide you with long-term growth and a source of passive income through dividends. However, it’s important to invest wisely and diversify your portfolio to reduce risk. You can invest in individual stocks, exchange-traded funds (ETFs), or mutual funds.

This can be as complicated as day trading or as simple as investing in low-cost index funds or ETFs. Long-term investing in the stock market has proven to be one of the greatest ways to accumulate wealth.

The challenge with long-term investing is holding through market ups and downs. Studies have shown that the less you trade your investments, the more time and compounding can work their magic.

Even Warren Buffett has said that for most people, investing in low-cost index funds is the best way to build wealth. Remember: time in the market beats timing the market.

With all-in-one ETFs now readily available, you can build a well-diversified portfolio with only a few clicks while paying very low management fees.

Buying individual stocks requires more time and work on your part. Investing is not just blindly buying companies but finding valuable ones and holding these investments as they grow.

You can also purchase dividend-paying stocks like banks or energy companies in Canada. These will pay you a portion of the company’s income through quarterly dividends, which you can use to buy more shares or other stocks.

Compounding dividends is another way to grow your wealth by the time you retire, and they also make for a great income stream as well.

4. Invest in Cryptocurrency

Cryptocurrency has been gaining popularity in recent years, and many Canadians have made significant gains by investing in Bitcoin, Ethereum, and other digital assets. However, it’s important to do your research and understand the risks involved before investing in cryptocurrency.

There is always an outside chance that any cryptocurrency can go to zero. Even worse, it can happen while you are sleeping as the markets are open 24 hours per day and 365 days per year.

There are plenty of crypto exchanges in Canada where you can get started. Before getting into crypto investing, we recommend doing your research and learning about how to buy cryptos and how to store them.

5. Save and Invest in RRSPs and TFSAs

Registered Retirement Savings Plans (RRSPs) and Tax-Free Savings Accounts (TFSAs) are two popular ways to save and invest for retirement in Canada. RRSPs allow you to defer taxes on your contributions until retirement, while TFSAs provide tax-free growth on your investments.

6. Invest in Gold and Silver

Investing in precious metals like gold and silver can provide a hedge against inflation and economic uncertainty. You can invest in physical gold and silver, or through exchange-traded funds (ETFs) and mutual funds that track the price of these metals.

7. Start a Side Hustle

A side hustle is a way to earn extra income outside of your full-time job. It can be a freelance gig, selling products online, or offering a service to your community. Starting a side hustle can help you increase your income and save more money to invest in your future.

If you stick with it, chances are you are closer to turning that side hustle into a legitimate business opportunity.

Having a side hustle implies you still have a 9 to 5 job. Balancing the two can be tricky, especially if your side hustle has grown over the past few years.

What exactly is a side hustle? You can be a freelancer or deliver food for a company like Skip the Dishes or Uber Eats. You can even use your career skills like graphic design or website building.

The gig economy is turning into full-time employment for millions of people, and having this extra income can bring you one step closer to reaching your financial goals.

8. Invest in Yourself

One of the best investments you can make is in yourself. This can include improving your skills and knowledge through courses, attending seminars and workshops, or hiring a mentor. By investing in yourself, you can increase your earning potential and open up new opportunities for growth and success.

9. Take Advantage of Tax Credits and Deductions

The Canadian government offers several tax credits and deductions that can help you save money and reduce your tax burden. These include the Home Buyers’ Plan, the Canada Child Benefit, and the Medical Expense Tax Credit. By taking advantage of these programs, you can keep more money in your pocket and put it towards your financial goals.

10. Live Below Your Means

One of the most important habits of millionaires is living below their means. This means spending less than you earn and avoiding unnecessary debt and expenses. By living below your means, you can save more money to invest in your future and achieve financial freedom.

How To Get Rich in Canada: 10 Ways To Become a Millionaire (2023)

To become a millionaire in Canada, you need to have a solid plan and the discipline to stick to it. Here are some tips on how to get rich in Canada:

- Start by setting a specific financial goal, such as saving for a down payment on a rental property or reaching a certain amount of net worth.

- Create a budget and stick to it. This means tracking your income and expenses and finding ways to reduce your expenses.

- Save and invest regularly. This can be done through automatic contributions to your RRSP or TFSA, or setting up automatic transfers to a separate savings account.

- Diversify your investments to reduce risk. This means investing in different asset classes, such as stocks, bonds, and real estate.

- Network and learn from successful people. This can be done through attending events, joining mastermind groups, or seeking out mentors and coaches.

- Be patient and persistent. Building wealth takes time and effort, so don’t give up if you don’t see results right away.

FAQs

- What is the fastest way to become a millionaire in Canada?

There is no one-size-fits-all answer to this question, as everyone’s financial situation is unique. However, some strategies that can help you build wealth quickly include investing in real estate, starting a successful business, or investing in high-growth stocks or cryptocurrencies.

- How much money do I need to start investing in Canada?

You don’t need a lot of money to start investing in Canada. Many brokerage firms and robo-advisors allow you to start investing with as little as $100. However, it’s important to do your research and choose investments that align with your financial goals and risk tolerance.

- What is the best way to save for retirement in Canada?

The best way to save for retirement in Canada depends on your personal circumstances and financial goals. Some popular options include contributing to an RRSP or TFSA, investing in a pension plan, or purchasing an annuity. It’s important to consider factors such as your age, income, and expected retirement lifestyle when choosing a retirement savings strategy.

- How do I know if I’m ready to start a business?

Starting a business can be a rewarding and lucrative venture, but it’s not for everyone. Some signs that you may be ready to start a business include having a passion for your product or service, having a solid business plan, and being prepared to take on the risks and challenges of entrepreneurship.

- Is it possible to become a millionaire on a modest salary in Canada?

Yes, it’s possible to become a millionaire on a modest salary in Canada.

- What are some common mistakes to avoid when trying to get rich in Canada?

Some common mistakes to avoid include taking on too much debt, investing in high-risk investments without proper research, and failing to diversify your portfolio. It’s also important to avoid lifestyle inflation and overspending, as this can hinder your ability to save and invest for the future.

- How can I stay motivated and focused on my financial goals?

One way to stay motivated is to track your progress and celebrate small wins along the way. It’s also helpful to surround yourself with supportive people and seek out mentorship and guidance from successful individuals in your field. Remember to stay focused on your long-term goals and be willing to adjust your strategy as needed.

Building wealth is a goal for many people, and there are several strategies you can use to achieve this goal. In this guide, we will cover the essential steps you need to take to build wealth in Canada.

- Define Your Goals

The first step in building wealth is to define your goals. What do you want to achieve? Is it to retire early, buy a house, pay off debt, or start a business? Once you have identified your goals, you can start developing a plan to achieve them.

- Create a Budget

A budget is a crucial tool for managing your money and achieving your financial goals. It helps you track your income and expenses, identify areas where you can cut back, and ensure that you are living within your means. To create a budget, you need to track your expenses for a few months, categorize them, and then set limits for each category.

- Reduce Your Expenses

Reducing your expenses is one of the most effective ways to increase your savings rate. You can reduce your expenses by cutting back on discretionary spending, negotiating bills, and shopping around for better deals on insurance, utilities, and other services.

- Increase Your Income

Increasing your income is another strategy for building wealth. You can do this by taking on a side hustle, negotiating a raise, or investing in your education and skills. The more money you earn, the more you can save and invest.

- Save and Invest

Saving and investing are the keys to building long-term wealth. You should aim to save at least 20% of your income and invest it in a diversified portfolio of stocks, bonds, and real estate. Investing in a tax-sheltered account like an RRSP or TFSA can also help you reduce your tax bill.

- Manage Debt

Managing your debt is also essential for building wealth. High-interest debt like credit cards and payday loans can eat into your savings and prevent you from reaching your financial goals. You should aim to pay off high-interest debt as quickly as possible and avoid taking on new debt unless it is for a necessary expense like a home or car.

- Protect Your Assets

Protecting your assets is an often-overlooked aspect of wealth-building. You should ensure that you have adequate insurance coverage for your home, car, and health. You should also consider estate planning to ensure that your assets are distributed according to your wishes after your death.

Conclusion

Becoming a millionaire in Canada is not easy, but it is possible with the right mindset and strategies. By saving and investing regularly, living below your means, and seeking out opportunities for growth and learning, you can build a strong financial foundation and achieve your goals. Remember to stay disciplined, stay focused on your long-term vision, and don’t be afraid to take calculated risks along the way.

Thank you for reading our guide on How To Get Rich in Canada: 10 Ways To Become a Millionaire (2023). We hope you found these tips helpful and informative. With dedication and hard work, you too can achieve financial success and live the life of your dreams.

5 thoughts on “How To Get Rich in Canada: 10 Ways To Become a Millionaire (2023)”